Employee dishonesty is more prevalent than we’d like to admit. Let’s face it: No one wants to think that one of their hand-picked employees may be stealing from them or cheating them. Yet it happens more often than we’d think. Keep reading to learn how to spot red flags with these steps to prevent business fraud at your company.

“Fraud is now so common that its occurrence is no longer remarkable, only its scale,” says the Association of Certified Fraud Examiners (ACFE). “Any organization that fails to protect itself appropriately faces increased vulnerability to fraud.”

Types of insider fraud

The risk of insider fraud, better known as occupational fraud, permeates every industry – even education, religion and charities. Occupational fraud is typically divided into three buckets: asset misappropriation (that’s the stapler you took home a few years ago and never returned), bribery/ corruption and financial statement fraud.

Besides inventory theft, asset misappropriation also includes theft of money, check forgery, payroll fraud or theft of services. It’s the most common type of fraud (happens in 91 percent of fraud schemes, says AllBusiness, but it’s also the least expensive type of fraud.

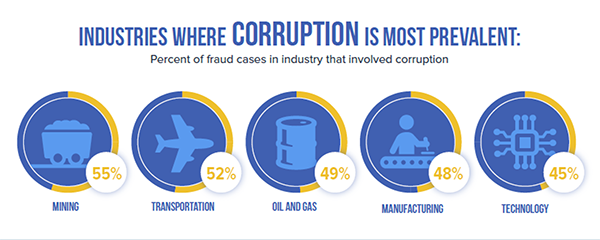

Bribery and corruption, the next bucket of fraud, occurs in about 30 percent of fraud cases. It can include manipulating contracts, substituting inferior goods, bribes to influence a decision, kickbacks and shell company schemes.

Financial statement fraud results in three times the loss as the other two combined, although it’s the least common, occurring in only 10 percent of cases. It includes manipulating financial statements in order to create financial wins for an individual or group, such as playing with stock prices, loan terms, or year-end bonuses.

What does a typical fraud event cost?

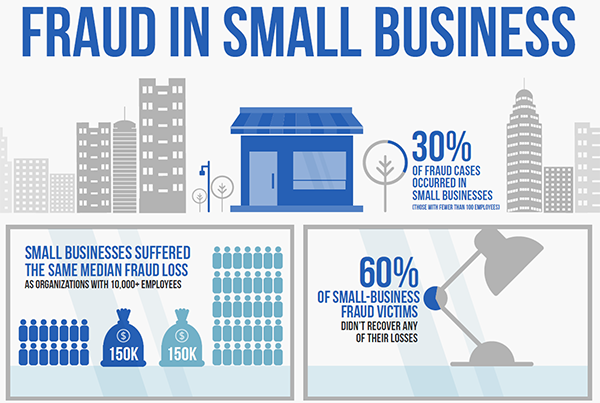

The typical organization loses five percent of its annual revenues to fraud, says ACFE and the Center for Forensic Economic Studies. The median loss from one case of occupational fraud is $150,000, but nearly a quarter of these occupational or insider fraud cases resulted in a loss upwards of $1 million. A portion of their infographic is at left.

At the high end of the spectrum are median losses in wholesale trade at $450,000, agriculture/forestry/fishing/hunting at $300,000 or construction at $259,000. We hear a lot about employee theft at retail organizations, yet their average case is $85,000. At the low end of the spectrum, as reported by ACFE, is education, at $62,000 per event. (Again, a portion of the ACFE infographic is below.)

Their studies also show that the more conspirers there are involved in a fraud, the higher the losses are: one person defrauds their company of an average of $65,000. Two people, $150,000. Five plus people, $633,000.

Why are small businesses more vulnerable?

If you own or manage a “small business” (i.e., less than 100 employees), know this: nearly one-third of fraud cases occur in small businesses. Even scarier, 60 percent of these companies didn’t recover any of their losses – and their median loss is $150,000.

Top fraud risks for small businesses are: Corruption, 30 percent. Billing schemes, 27 percent. Skimming, 20 percent. Check tampering, 20 percent. Non-cash misappropriation, 19 percent.

When they spot fraud, these organizations of 100 employees or less typically detect it in one of these ways:

- A tip – 30 percent

- Management review – 15 percent

- Internal audit – 12 percent

- Account reconciliation – 8 percent

- Just by accident – 7 percent

Here’s the kicker: We all think it won’t happen to us. Our employees like us; no one would cheat us. We like to think we keep a close eye on the books and take basic steps to prevent fraud. And our head-in-the-sand attitude costs: companies without anti-fraud controls suffered twice the losses of those that had controls in place. Those controls are typically management review, proactive data monitoring and analysis, and an employee hotline.

Steps to prevent business fraud

ACFE lists six steps to prevent fraud that every organization should consider to reduce your vulnerability:

1. Establish a code of ethics for management and employees, and have each employee sign the document.

2. Evaluate your internal controls for effectiveness and identify areas that may be vulnerable.

3. Institute more checks and balances, such as

- Adding an audit department and/or an independent audit committee

- Requiring management review and certification of financial statements

- Requiring a consistent external audit of both financial statements and of your internal controls over financial reporting

- Conducting random surprise audits

- Instituting mandatory vacations or job rotation

4. Hone your hiring procedures. Conduct thorough background checks that include educational, credit and employment history, plus references.

5. Create a tip line. ACFE says fraud is most likely to be detected by a tip, so provide an anonymous reporting system for employees, contractors and clients.

6. Communicate your stance on fraud – consistently. This is perhaps the most crucial of steps to prevent business fraud. Remind staff of your anti-fraud policies and potential consequences, and that your tip line is anonymous and easy-to-use. Consider anti-fraud training for executives, managers and employees.

This blogpost originally ran on Arrowhead’s corporate blog. It has been modified and updated to better fit the needs of our Investigation Solution clients.